Umbrella insurance, often overlooked in standard insurance planning, acts as a crucial safety net, extending coverage beyond the limits of your existing auto and homeowners’ insurance policies.

As bigluxy.com might emphasize, understanding its intricacies is key to securing your financial future against significant liability risks. This in-depth guide will explore every facet of umbrella insurance, empowering you to make informed decisions about protecting your assets.

What is Umbrella Insurance?

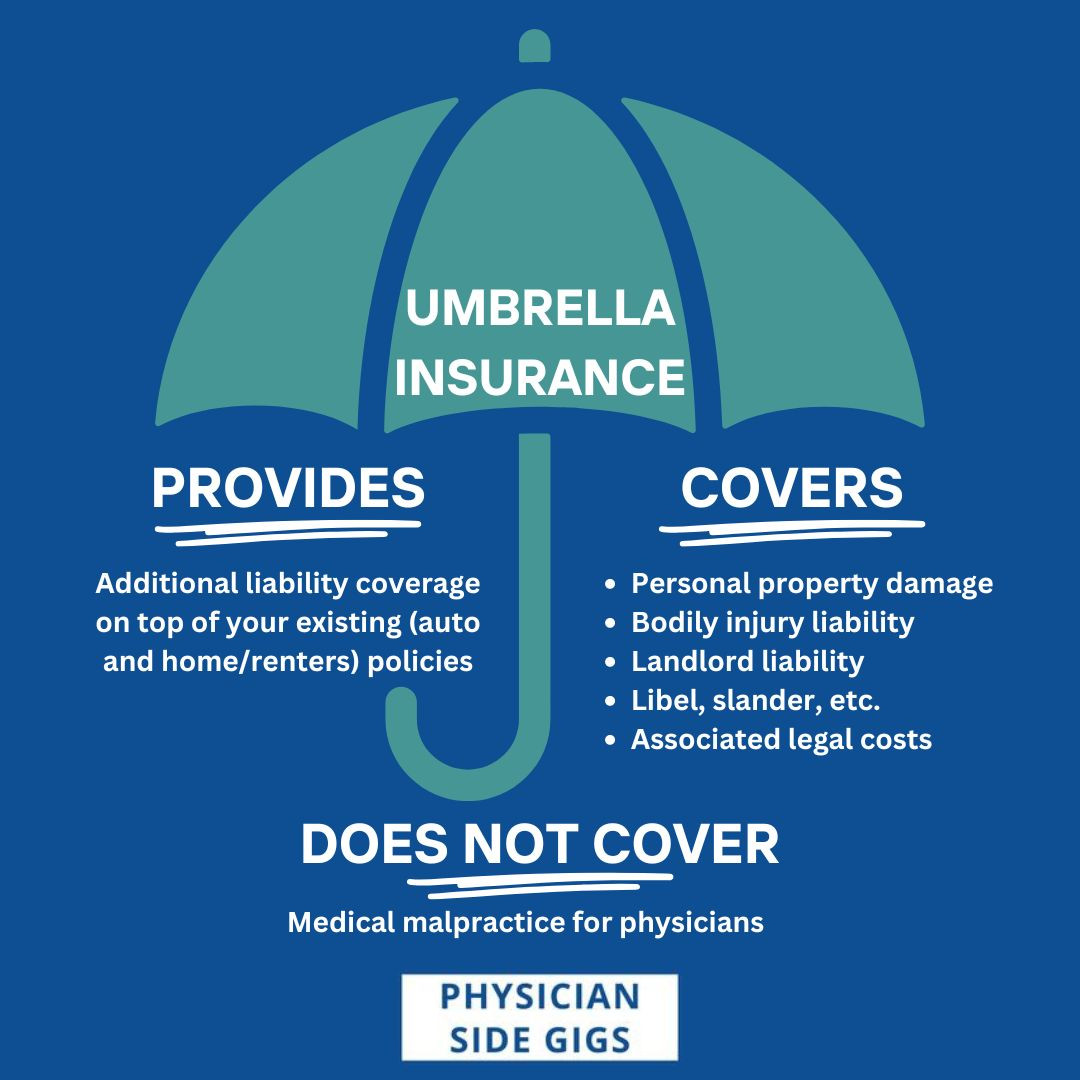

Umbrella insurance is a supplemental liability insurance policy designed to provide additional coverage beyond the limits of your primary liability policies, such as auto and homeowners’ insurance. It acts as a “safety net,” protecting your assets and finances from catastrophic lawsuits or judgments that exceed your existing coverage limits. Think of it as an extra layer of protection, providing broader and higher liability limits.

Why You Need Umbrella Insurance

Higher Liability Limits: Standard auto and homeowners’ policies often have relatively low liability limits. A single accident or incident could easily result in claims exceeding these limits, leaving you personally responsible for the difference.

Asset Protection: A significant lawsuit could jeopardize your assets, including your home, savings, and investments. Umbrella insurance shields these assets by covering the excess liability.

Peace of Mind: Knowing you have comprehensive liability coverage can provide significant peace of mind, allowing you to focus on other aspects of your life without the constant worry of potential financial ruin.

Coverage for Specific Situations: Umbrella policies often cover situations not fully covered by standard policies, such as libel, slander, or invasion of privacy.

Affordability: Despite the extensive coverage, umbrella insurance is surprisingly affordable for many individuals. The cost is usually far less than the potential financial devastation a large lawsuit could cause.

How Umbrella Insurance Works

Umbrella insurance works by providing additional liability coverage *after* your underlying liability policies (auto and homeowners) have been exhausted. It kicks in when the claims exceed those limits. For example, if you have a $300,000 liability limit on your auto policy and a $500,000 liability limit on your homeowner’s policy, and a $1 million umbrella policy, you’d have a total liability coverage of $1.8 million.

What Does Umbrella Insurance Cover?

Bodily Injury Liability: Covers medical expenses, lost wages, and other costs associated with injuries you cause to others.

Property Damage Liability: Covers damages to someone else’s property that you’re responsible for.

Personal Liability: Covers claims of personal injury or property damage that arise outside of your auto or home, such as a slip and fall on your property.

Other Coverage: Depending on the policy, umbrella insurance may also cover additional expenses, such as legal defense costs and court fees.

What Umbrella Insurance Doesn’t Cover

Intentional Acts: Umbrella insurance generally doesn’t cover intentional acts of harm or damage.

Business Liability: Separate business liability insurance is required for business-related activities.

Specific Exclusions: Like all insurance policies, umbrella insurance has specific exclusions outlined in the policy document. It’s crucial to review these carefully.

How Much Umbrella Insurance Do You Need?

The amount of umbrella insurance you need depends on several factors, including your assets, net worth, and potential liability exposure. As a general rule, many financial advisors recommend at least $1 million in umbrella coverage, but higher limits may be necessary depending on your individual circumstances. Consulting with an insurance professional is highly recommended to determine the appropriate coverage level.

How to Get Umbrella Insurance

Obtaining umbrella insurance is generally straightforward. You’ll need to provide information about your existing auto and homeowners’ insurance policies, your driving record, and your personal and financial information. Insurance companies will assess your risk profile and provide quotes based on your individual circumstances. Shopping around and comparing quotes from different insurers is crucial to finding the best coverage at the most competitive price.

Understanding the Fine Print: Policy Details and Exclusions

Before purchasing an umbrella policy, carefully review the policy documents to understand the specific coverage details and any exclusions. Pay close attention to the following aspects:

- Policy Limits: Understand the total amount of coverage provided by the policy.

- Deductibles: Determine the amount you’ll have to pay out-of-pocket before the insurance coverage kicks in.

- Exclusions: Identify any specific situations or events that are not covered by the policy.

- Coverage Territory: Clarify the geographic areas where the coverage applies.

- Claims Process: Understand the steps involved in filing a claim under the umbrella policy.

Umbrella Insurance and Other Insurance Policies

Umbrella insurance works in conjunction with your existing auto and homeowners insurance policies. It’s crucial to have adequate underlying liability coverage before purchasing an umbrella policy. The umbrella policy supplements, not replaces, your primary insurance.

The Cost of Umbrella Insurance

The cost of umbrella insurance varies based on factors such as your location, claims history, and the amount of coverage you choose. Generally, it’s relatively inexpensive compared to the potential costs associated with a significant liability claim. Shopping around and comparing quotes from multiple insurers can help you find the most affordable options.

Frequently Asked Questions (FAQs)

Q: Can I get umbrella insurance without homeowners or auto insurance? A: While it is possible in some cases, most insurers require you to have underlying liability insurance (auto and/or homeowners) before purchasing an umbrella policy.

Q: What happens if I have multiple claims? A: The policy will cover multiple claims within the policy limits. However, each claim will be assessed individually.

Q: How long does it take to get an umbrella insurance policy? A: The application and approval process usually takes a few days to a few weeks.

Q: Can I cancel my umbrella insurance policy? A: Yes, you can usually cancel your umbrella insurance policy at any time, but you may be subject to cancellation fees depending on the terms of your policy.

Q: What if my assets are less than my liability coverage? A: Even if your assets are less than your liability coverage, having an umbrella policy will help protect your assets from being seized in the event of a lawsuit. The insurance company will be responsible for covering the liability up to the policy limits.